5 ways to reduce your business overhead costs

Either with baby steps or in big leaps

When times are tough, being able to reduce your business’s overhead costs can really save the day. While operating costs are a necessary evil (it’s hard to do business without paying for real estate, utilities, staff, office supplies, or advertising...), there are smart ways to cut the fat, especially if you’re willing to think outside the box, run a tight ship and excuse the mixed metaphors.

1. Reduce your real estate spend

If your business is like most, your largest overhead will be rent. But how well are you using your space? Could you downsize or monetise your real estate if you used it more efficiently?

For baby steps, try engaging with the sharing economy to cover real estate costs:

- If you have some office or retail space that isn’t used, you can list it on platforms like Sharedspace or CoFinder to find hot deskers.

- If you have underused parking space, list it for free on Parkable and reach thousands of people searching for parking. Restaurants and small businesses use Parkable to cover their car park leasing costs and generate extra income.

If you want to try something more drastic, you may be able to switch to a smaller office or retail space, move to a less expensive location, or even set up a home office with employees working remotely.

While those might sound like measures only suitable for very small businesses, they can be an excellent option for medium and large companies, too. Increasingly, businesses like Automattic, which has 930 staff, are going office-free with all employees working remotely. Moving to the city-fringe is also attractive; in 2018 Parkable moved from the Auckland CBD to Morningside, tempted by the larger space, lower rent, and opportunity to be part of an up-and-coming business hub.

Up-and-coming business and social hub Morningside

2. Buy pre-loved rather than brand new

Some business expenses come up suddenly, and things need to be replaced - your work computer calls it quits, your vehicle breaks down, or a customer spills so much coffee on your cream carpeting that it’s just gotta go. Rather than buying a new model, look into second-hand versions, or if you’re in a place to invest in the future, choose an option that will be cheaper in the long-run.

- Vehicles:TradeMe and Gumtree are your friends. Keep an eye out for pre-loved vehicles in good condition, and if you want to invest now and reduce fuel costs well into the future, consider a second-hand EV or hybrid.

- Tech equipment: Buy refurbished tech from companies like GoodTech and Reboot IT to save money - and get on the reduce, reuse, recycle wagon.

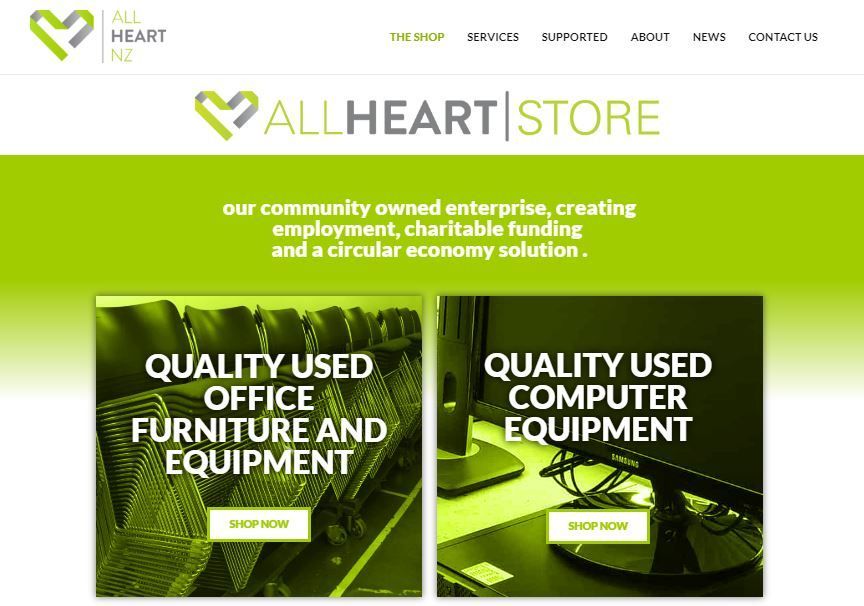

- Furniture: For all sorts, check out All Heart NZ, a charity that repurposes used business equipment and puts the proceeds toward Pacific communities. In Australia, try Sustainable Office Solutions for quality salvaged furniture.

- And the carpet?: Yep, you can buy that second-hand on TradeMe and Gumtree, too!

All Heart NZ furniture and equipment store

3. Make technology your friend

Many pricey business activities are now much cheaper - when you do them online. Here are a couple of examples to get you thinking:

- Use open-source software like Google Drive and OpenOffice.org instead of shelling out for paid applications.

- If you or staff need to learn new skills, try free online training programmes, as well as splashing out on in-person courses when it’s really important.

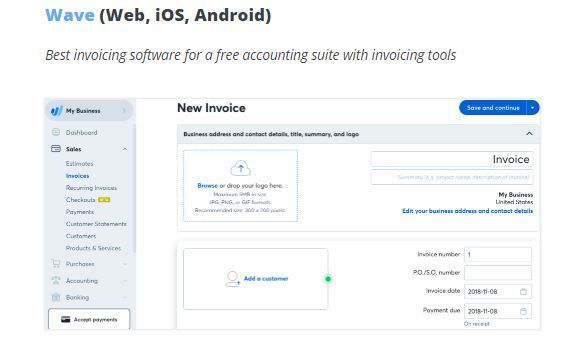

- Email receipts and invoices to save on printing costs. This blog compiles 19 online invoicing apps for you to compare (what a hoot!).

- Advertise and market your business cheaply online. Options include Google Ads, social media marketing, and blogging. Read more about promoting your business for free online here in a brilliant, witty, and totally readable blog (yes, we wrote it).

Wave - number 1 on the list of 19 free invoicing tools.

4. Make smart employment decisions

Another significant operating cost, of course, is paying your staff. Sadly, it’s sometimes necessary to let people go in order to keep a business afloat. If things are tight but you want to avoid such drastic measures, you could consider different employment options:

- Hire contractors rather than long-term employees, so you have more spending flexibility. For quick tips on hiring contractors, look here.

- Hire part-time staff, or see if full-time staff are willing to reduce their hours or take unpaid leave during slow periods.

- Ask family members to help out. It may surprise you to discover that a family member is a great skill fit for your business and is happy to pitch in when you need an extra pair of hands. Of course, don’t dive in without thinking it through - Forbes offers some issues to consider before hiring family.

- When you do hire employees, try to find people who can fill multiple roles. For example, if you’re looking for a retail assistant, try to find someone who also has experience in social media marketing or graphic design, so they can contribute even more value to your business.

For more ideas on cutting hours while keeping staff, click here.

Xero's free guide to hiring independent contractors - check it out here.

5. Create (and stick to) a business budget

It’s all too easy to overspend when you aren’t closely tracking your payments, and aren’t holding yourself to account against a budget. Daily flat whites paid out of the till and staff drinks every Friday? No problem!

Equally problematic is that without a business budget, you won’t be able to answer questions like ‘how much do we need to sell to remain profitable next month?’ or ‘can I afford an extra staff member over Christmas?’ This can leave you feeling overwhelmed, uncertain and paralysed.

To get started on your business budget, have a read through this helpful guide by Xero. As its author Emma Northcote-Green says, “...a budget gives you more certainty and confidence. You get a clearer picture of the state of your business and you know where you stand. It’s like turning on a light in a dark room.”

Smart software Xero recommends to show clearly your income and expenditure.

Hopefully this gave you a few ideas, and maybe even made you think ‘wow! Parkable sounds cool.’ ;)

Suggested articles

Increasing happiness among your team is a great end unto itself, and also positive for the overall success of your business. A great work culture helps businesses to attract and retain excellent employees and motivate a better work ethic.

Whatever the symptoms, combatting demotivation is worth the effort; left to fester, it can have a significant impact on productivity, retention, customer service, and profitability. Here are 5 tips to boost motivation.

Small New Zealand businesses like Gina’s Italian Kitchen and La Marzocco are using Parkable to make sure their parking space is always in use, and to create extra income.

Solve your parking problems

If you have workplace parking spots and want to...

- Improve employee parking experiences

- Reduce car park admin

- Make better use of your space

- Align your parking with a flexible working culture

- Implement hardware solutions

Blog

Blog